This week we are learning about the Break Retest Break (BRB) strategy for trading the Steem token. I was busy with my work and studies but from today I will start proper work on this strategy. This is not just theory its practical and will help with daily trading. By participate in this competition I will learn the basic of the BRB strategy and How to use it to manage trade and get better results. whether you are experience trader or just started out this competition is great chance to learn practice and shared with a community that love trading.

The Break Retest Break (BRB) strategy helps traders make money by following trends in the market. It has three steps the initial break the retest and the subsequent break. Let me explain each step and how it applies to trading Steem.

- Initial Break: This is when the price breaks through a key level like a support or resistance. For example if Steem jumps from $0.20 to $0.25 suddenly thats an initial break.

- Retest: After the initial break the price often comes back to test the new level it broke through. If it hold above this level like staying above $0.20 after breaking it that confirms the break.

- Subsequent Break: Once the price confirms the break by holding above the level and then break higher again like going above $0.25 after holding at $0.20 it confirm trend continuation.

-

Applying the BRB Strategy to Steem Trading

Here how I use the BRB strategy for Steem:

- Identify Levels: Find important support and resistance levels on the Steem chart.

- Wait for Break: Look for a clear break above level backed by strong trading volume.

- Confirm and Enter: After the break wait for a retest and confirmation. Enter the trade when the price breaks higher again with a plan to manage risk and set targets.

Specific Entry Criteria Using the BRB Strategy for Steem TradingWhen I use the Break Retest Break (BRB) strategy to trade Steem I look for specific signals to enter a position. Here’s how I approach it:

- Identifying Key Levels:

- First I analyze Steem price chart to find important support and resistance levels. These levels are crucial because they mark where the price might break out or reverse.

- Initial Break:

- I wait for Steem to break above a significant resistance level. For example if Steem usually trades around $0.20 and suddenly rises to $0.22 that’s an initial break.

- Confirmation of Break:

- After the break I watch closely to see if the price pulls back to retest the $0.20 level which has now become support. If the price holds above $0.20 during this retest it confirms that the breakout might be real.

- Technical Indicators:

- Volume: I check if the breakout is support by increased trading volume. high volume confirms strong interest and potential Continuation of the up trend.

- Candlestick Patterns : Looking for bullish candlestick patterns like big green candle or pattern that show buyers are in control helps me confirm the strength of the breakout.

- Moving Averages: I use moving averages to understand the trend direction. When shorter-term averages cross above longer-term ones it often signal a bullish trend.

- RSI (Relative Strength Index): If the RSI is above 50 it suggest bullish momentum and support my decision to enter the trade.

- Entry Point:

- Once I see the price break above the recent high after the retest (say above $0.22) I take that as my signal to enter the trade. This second breakout confirms that the uptrend is likely continuing.

- Managing Risk:

- To manage risk I set a stop-loss just below the initial breakout level (around $0.20 in this example). This helps protect my capital in case the price reverses.

Example Scenario:

- Identify Key Level: I notice Steem has been struggling around $0.20.

- Initial Break: Steem suddenly breaks above $0.20 reaching $0.22 with strong volume.

- Retest: The price pulls back to $0.20 but it holds steady without dropping below.

- Confirmation: I see bullish candlestick patterns and RSI above 50.

- Subsequent Break: Steem then breaks above $0.22 confirming the uptrend is continuing.

- Entry: I decide to enter the trade at $0.23 with a stop-loss set at $0.19 to manage my risk.

- Profit Target: I set my profit targets based on resistance levels or previous highs adjusting with trailing stops to maximize gain.

Exit Criteria Using the BRB StrategyWhen I trade using the Break Retest Break (BRB) strategy knowing when to exit Position is just important as knowing when to enter. Here how I decide to close a trade whether in profit or loss:

- Profitable Exit Criteria:

- Target Price Reached: I set a specific profit target based on resistance levels or previous highs. When the price reaches this target its a signal to consider closing the position to lock in profits.

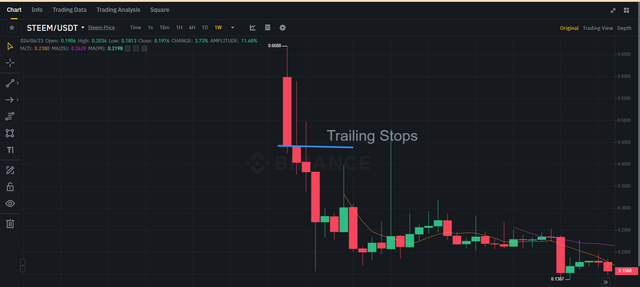

- Trailing Stops: As the price moves in my favor I adjust my stop loss higher (if long) or lower (if short) to protect

profits. Trailing stops help capture gain while allowing rooms for the price to continue it trend.

- Technical Indicators: If technical indicators such overbought conditions (high RSI) or bearish candlestick patterns suggest potential reversal I may choose to exit the trade to secure profits before the trend reverses.

- Loss Minimizing Exit Criteria:

- Stop Loss Hit: I always set a stop-loss when entering trade to limit potential losses. If the price hits my stop-loss level it triggers an automatic exit to prevent further loss.

- Invalidation of Setup: If the initial breakout level (where I entered) fails to hold support upon retesting it indicates the setup may be invalid. In such cases I exit the trade to minimize losses and reassess the market conditions.

- Market Conditions:

- Volatility Changes: If the market becomes highly volatile or unpredictable causing significant price swings against my position I may consider exiting to protect capital.

- News or Events: Unexpected news or events that affect the cryptocurrency market and Steem token specifically could prompt me to exit position earlier than planned to avoid potential adverse impacts.

Example Scenario:

- Profitable Exit: Suppose I enter a trade at $0.23 after confirmed breakout above $0.20. My profit target is $0.30 based on previous resistance levels. When the price reaches $0.30 I decide to close the trade to lock in a profit of $0.07 per token.

- LossMinimizing Exit: If I set stoploss at $0.19 and the price drops to trigger this stop-loss I exit the trade with a manageable loss of $0.04 per token.

- Adapting to Market Conditions: In highly volatile market if the price shows signs of reversal after hitting my profit target or if unexpected negative news affects Steem price I may exit the trade earlier than planned to protect my capital.

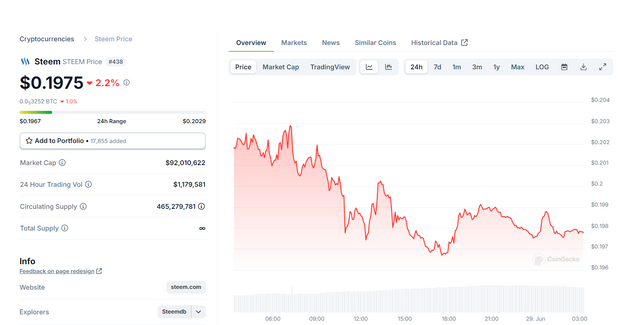

Example of a BRB Trade on Steem TokenI want to share a recent trade I made using the Break Retest Break (BRB) strategy on the Steem token. This strategy helps me identify potential buying opportunities and manage trades effectively.

1. Identifying the Setup

- Chart Analysis: I noticed that Steem had been struggling around the $0.20 mark which acted as resistance level in the past. This Level caught my attention as a potential breakout point.

2. Initial Break

- Entry Point: Steem finally broke above the $0.20 resistance level rallying to $0.22.

- Reasoning: This breakout was accompanied by a surge in trading volume suggesting strong buying interest. I Saw this a signal that the downtrend might be reversing making it a good time to consider entering long Position.

3. Retest

- Pullback: After hitting $0.22 Steem pulled back to retest the $0.20 level.

- Confirmation: Importantly during this pullback the price held above $0.20 indicating that previou resistance had turned into support. This confirmation strengthened my belief in the breakout.

4. Subsequent Break

- Second Breakout: Steem then continued its upward movement breaking above the recent high of $0.22 and reaching $0.25.

- Entry Confirmation: I decided to enter the trade $0.23 just above the recent high after the retest anticipating further price appreciation.

- Reasoning: The second breakout above $0.22 confirmed to me that the bullish trend was likely to continue. It was clear signal to participate in the uptrend.

5. Exit Strategy

- Profit Target: My profit target was set at $0.30 based on the next significant resistance level seen on the chart.

- Reasoning: $0.30 was a historical resistance level Where Steem had previously stalled. Closing the trade at this level allowed me to lock in profits before potential resistance could halt further gains.

- Stop Loss: I placed a stop-loss at $0.19 just below the initial breakout level of $0.20.

- Reasoning: This stop-loss protected my capital in case the breakout failed to hold. If the price drop back below $0.20 it would indicate that the trade setup might no longer be valid.

In conclusion by applying the BRB strategy I identified promising trade setup in Steem entered strategically at breakout point and managed the trade with Clear exit strategies. This approach help me navigate the cryptocurrency market with confidence aiming to maximize profits while minimizing risk. Managing Risk and Capital with the BRB StrategyWhen I trade using the Break Retest Break (BRB) strategy I focus on protecting my capital while maximizing potential gains. Here’s how I manage risk:

1. Setting Stop Loss Orders

- Purpose: A stop-loss order is essential to limit potential losses on a trade.

- Placement: I set my stop-loss just below the initial breakout level typically around the support turned resistance level.

- Example: If I enter a trade at $0.23 after breakout above $0.20 I might place my stop loss at $0.19. This level acts as buffer against price reversals that could invalidate the trade setup.

2. Using Trailing Stops

- Purpose: Trailing stops help protect profits as the trade moves in my favor.

- Implementation: As the price moves up I adjust my stop loss upwards (if long) to lock in profits. This allows me to capture gains while still giving the trade room to develop.

- Example: If Steem rises from $0.23 to $0.30 I might adjust my stop loss from $0.19 to $0.25. This ensures that if the price reverse I exit with a profit rather than giving back gains.

3. Setting Profit Targets

- Purpose: Profit targets help me define when to take profits and exit trade.

- Strategy: I set targets based on resistance levels or historical price movements aiming to capture potential upside before the price encounters resistance.

- Example: With Steem if my entry is at $0.23 I might set a profit target at $0.30 based on previous highs. Closing the trade at this level allows me to lock in profits before potential resistance might halt further gains.

4. Risk to Reward Ratio

- Consideration: Before entering a trade I always asses the risk to reward ratio.

- Ratio: I aim for favorable ratio where the potential reward outweighs the risk. This help ensured that even if not all trades are profitable the one that are can offset loses.

- Example: If my Stop los is at $0.19 & my profit targets is $0.30 the risk to reward ratio Would be calculate the potential Gain ($0.30 – $0.23 = $0.07) divide by the potentials los ($0.23 – $0.19 = $0.04) resulting in ratio of 1.75:1.

5. Adapting to Market Conditions

- Flexibility: I remain flexible and adjust my risk management approach based on market conditions and volatilty.

- Monitoring: Continuous monitoring of the trade and markets developments helps me make informed decisions to adjust stops or take profits if necessary.

- Example: During periods of heightened volatility or unexpected news affecting Steems price I may tighten stops or secure profit earlier to protect against adverse market movement.

By implementing these risk management techniques with the BRB strategy I aim to preserve capital and optimize returns in my trading activities with Steem. This approach not only help me navigate the inherent risks of cryptocurrency trading but also allows me to capitalize on opportunitie with confidence.

.png)

.png)

.png)

.png)

.png)

.png)