What is API and why is it used?

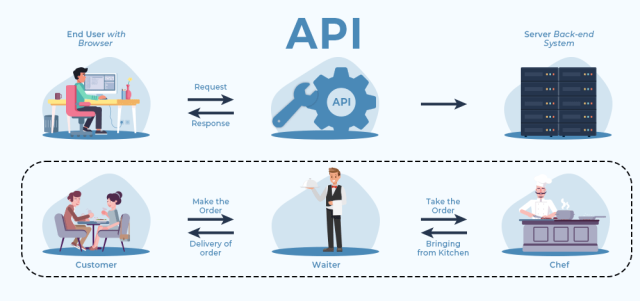

API stands for Application Programming Interface. It is a set of rules, protocols, and tools that allows different software applications to communicate with each other. APIs define the methods and data formats that applications can use to request and exchange information. Here’s why APIs are used and their significance:

1. **Integration**: APIs facilitate the integration of different software systems, allowing them to work together and share data seamlessly. For example, an e-commerce website can use payment APIs to securely process transactions with payment gateways.

2. **Modularity**: APIs allow developers to create modular and reusable code. Instead of reinventing the wheel, developers can use APIs provided by other developers or companies to add specific functionalities to their applications.

3. **Abstraction**: APIs abstract the complexity of underlying systems. Developers can interact with APIs through well-defined interfaces without needing to understand the internal workings of the systems they are integrating with.

4. **Extensibility**: APIs make it easier to extend the functionality of software applications. Developers can add new features or capabilities by integrating with APIs that provide those functionalities.

5. **Standardization**: APIs often adhere to specific standards and conventions, making it easier for developers to understand how to use them. This standardization promotes consistency and interoperability across different applications and platforms.

6. **Automation**: APIs enable automation by allowing systems to communicate and perform tasks programmatically. For example, APIs are used in cloud computing to automate provisioning, scaling, and management of resources.

7. **Ecosystems**: APIs help create ecosystems where developers, partners, and third-party providers can build complementary services and tools around a core platform or service. This fosters innovation and expands the capabilities of the platform.

8. **Security**: APIs can include mechanisms for authentication, authorization, and data encryption, ensuring secure access to resources and protecting sensitive information.

In summary, APIs are used to enable communication and interaction between software applications, improve development efficiency, promote interoperability, and facilitate the creation of interconnected systems and services in the digital world. They are fundamental to modern software development and play a crucial role in driving innovation and integration across various domains.