Forty third Week as a Steem Representative – CW 26

Deutsch im Anschluß…

Dear Steemians and Dear Steemit Team!

Sometimes events come thick and fast… For a few weeks there was little to nothing to report, and then all of a sudden the news – and the requests – rush in.

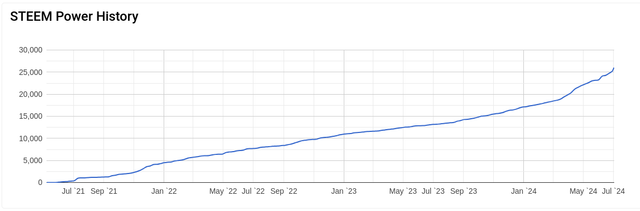

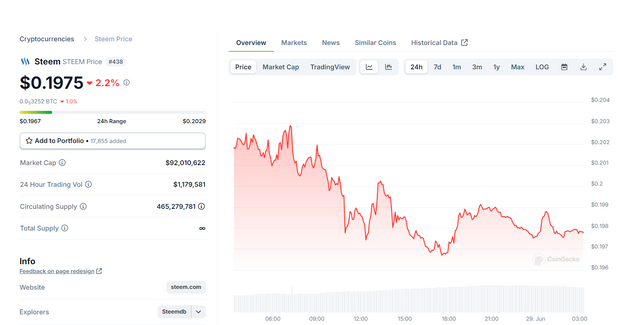

After completing a few projects, I had more time again and was finally able to post more intensively myself. Did I mention that I now really miss it when I’m too busy? At least it’s a sign that I’m feeling pretty good again here on the Steem!

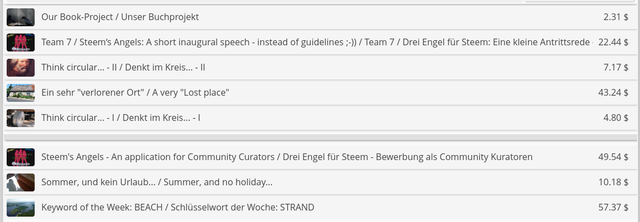

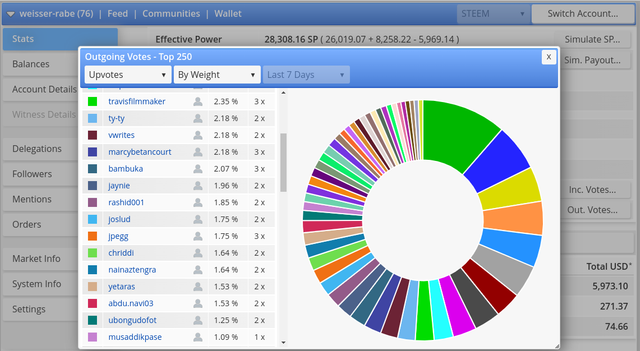

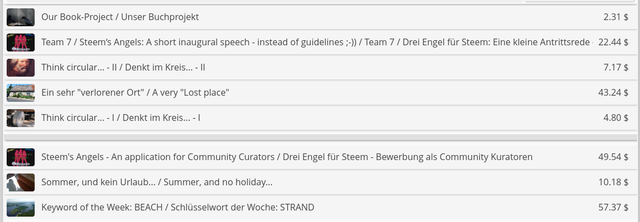

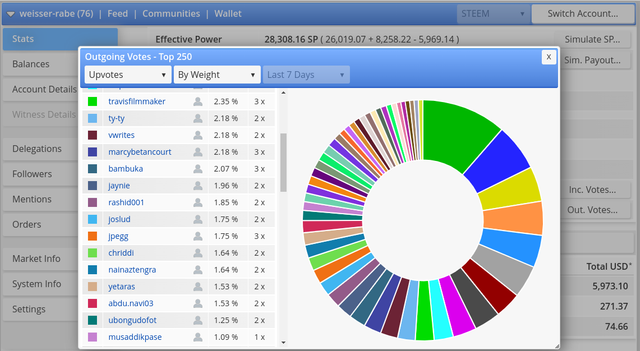

Of course, I’ve also been curating daily, both with my private account and the Community and Charity Accounts of the Dream Steem Community. Incidentally, the Community is enjoying healthy growth; with just over 60 permanently active authors, we’re doing a pretty good job of keeping our “hard core” in line. The contributions are gradually improving and special thanks for this go to, among others @soulfuldreamer, who brings out the best in all of us with her ingenious and thought-provoking competitions:

https://steemit.moecki.online/hive-107855/@soulfuldreamer/contest-announcement-think-circular

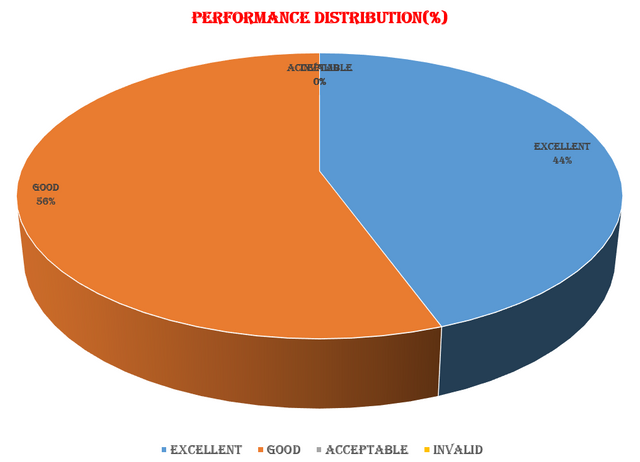

A small caveat to my enthusiasm: the recent past has also brought a few not-so-serious users to us, with whom various disputes are ongoing or no longer being conducted. We have a newcomer who immediately introduced himself to us with plagiarism, as well as another new colleague who, despite being admonished, has his posts made rather clumsily by a chatbot he trusts. And there are also users who are under undeclared pressure to post every day, but simply have no ideas of their own. As a result, they retell Disney classics or folk tales or stories written by their distant friends. It just makes me sad…

In any case, we are one step closer to the planned book publication; the longlist for the text selection will be turned into a shortlist in the next few days. The authors involved have to give their consent and comment on the possibility of their real names being mentioned…

https://steemit.com/hive-107855/@weisser-rabe/our-book-project-unser-buchprojekt

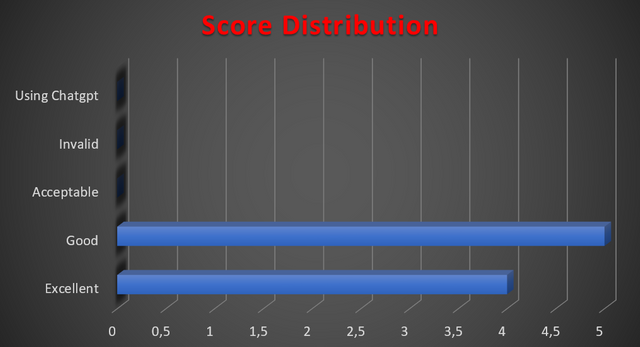

Well, and then, out of sheer exuberance, I took the plunge again after a long time and applied to become a Community Curator; with a hand-picked team of committed and capable authors. Thank you for placing your trust in us and allowing us to serve as Steem s Angels for the month of July!

And that brings me to my second downer for today: we curate independently of club membership and other conditions. Out of statistical interest, I check them anyway; after all, we want to know how many valuable authors have slipped through all the nets because of the club conditions… To my surprise, I found a lot of authors who don’t belong to a club but use the club tags. In most cases I assume a lack of understanding about the exact interpretation of the club rules. It would be helpful if these could be found somewhere in a centralised location for the duration of their validity. Apparently there are also incorrect instructions in some Communities, which in turn is based on misinterpretations.

However, I have also come across experienced Steemians who cheerfully use all three club tags – and this includes users who have applied to become Community Curators themselves…

The opposite can also be experienced; Steemians who actually belong to #club75 or #club100, but use the modest #club5050 tag.

My conclusion is again similar to the one I’ve often drawn: more clear communication is needed at all corners and ends! Then it will work with the Steem…

Yours @weisser-rabe

Deutsche Version:

Liebe Steemians und liebes Steemit-Team!

Manchmal überschlagen sich die Ereignisse… Es gab ein paar Wochen so mäßig bis kaum etwas zu berichten, und auf einmal überstürzen sich die Neuigkeiten – und die Anliegen.

Nach Abschluß einiger Projekte hatte ich wieder mehr Zeit und konnte selber endlich wieder einmal intensiv posten. Hatte ich erwähnt, daß mir das mittlerweile richtig fehlt, wenn ich zu eingespannt dafür bin? Immerhin ein Zeichen, daß ich mich wieder recht wohl fühle, hier auf dem Steem!

Außerdem habe ich natürlich täglich kuratiert, sowohl mit meinem privaten Account als auch den Community und Charity Accounts der Dream Steem Community. Die erfreut sich im übrigen eines gesunden Wachstums; mit etwas über 60 permanent aktiven Autoren halten wir unseren „harten Kern“ ganz gut bei der Stange. Die Beiträge verbessern sich sukzessive und ganz besonderer Dank dafür gehört u.a. @soulfuldreamer, die mit ihren genialen und zum Nachdenken anregenden Wettbewerben das Beste aus uns allen hervor lockt:

https://steemit.moecki.online/hive-107855/@soulfuldreamer/contest-announcement-think-circular

Kleine Einschränkung meiner Begeisterung: die jüngere Vergangenheit brachte auch ein paar nicht so seriöse Nutzer zu uns, mit denen verschiedene Dispute laufen bzw. auch nicht mehr geführt werden. Wir haben einen Newcomer, der sich sogleich mit Plagiaten bei uns einführte, außerdem einen anderen neuen Kollegen, der seine Posts trotz Ermahnung recht unbeholfen von einem Chatbot seines Vertrauens anfertigen läßt. Und es gibt auch Nutzer, die aus einem nicht erklärten Druck heraus unbedingt täglich posten wollen, aber schlicht keine eigenen Ideen haben. Sie erzählen demzufolge Disney-Klassiker nach oder Volksmärchen oder Geschichten, die ihre entfernten Freunde geschrieben haben. Mich macht das einfach nur traurig…

Einen Schritt weiter sind wir jedenfalls in Sachen der geplanten Buchveröffentlichung; aus der nun vorliegenden Longlist für die Textauswahl wird in den nächsten Tagen eine Shortlist. Die involvierten Autoren müssen ihr Einverständnis bekunden und sich zur möglichen Nennung ihres Klarnamens äußern…

https://steemit.com/hive-107855/@weisser-rabe/our-book-project-unser-buchprojekt

Tja, und dann habe ich vor lauter Übermut nach langer Zeit wieder den Schritt gewagt, mich als Community Kuratorin zu bewerben; mit einem handverlesenen Team engagierter und fähiger Autorinnen. Danke, daß uns das Vertrauen ausgesprochen wurde und wir im Monat Juli als Drei Engel für Steem unseres Amtes walten dürfen!

Und dabei wäre ich gleich bei meinem zweiten Wermutstropfen für heute: wir kuratieren unabhängig von Clubzugehörigkeit und anderen Bedingungen. Aus statistischem Interesse checke ich diese trotzdem; immerhin wollen wir wissen, wie viele wertvolle Autoren uns durch die Clubbedingungen durch alle Netze gerutscht sind… Gefunden habe ich zu meiner Überraschung eine Menge Autoren, die keinem Club angehören, aber die Clubtags benutzen. In den meisten Fällen gehe ich von Unverständnis über genaue Auslegung der Clubregeln aus. Es wäre hilfreich, wenn diese für die Dauer ihrer Gültigkeit irgendwo zentral nachzulesen wären. Scheinbar gibt es in einigen Communities auch falsche Anleitungen dazu, was wiederum auf Fehlinterpretationen beruht.

Allerdings stieß ich auch auf durchaus erfahrene Steemians, die munter alle drei Clubtags benutzen – und das betrifft u.a. Nutzer, die sich selbst als Community Kuratoren beworben haben…

Das Gegenteil kann man ebenfalls erleben; Steemians, die eigentlich #club75 oder #club100 angehören, aber den bescheidenen #club5050 tag verwenden.

Mein Fazit ähnelt wiederum dem, das ich schon häufiger zog: es braucht an allen Ecken und Enden mehr klare Kommunikation! Dann klappt es auch mit dem Steem…

Euer @weisser-rabe

vs.

vs.

vs.

vs.

.png)

.png)

.png)

.png)

.png)

.png)